Other Words to Describe Determination of a Fair Market Value

Asset Market Value vs Asset Book. In other words this is called special value.

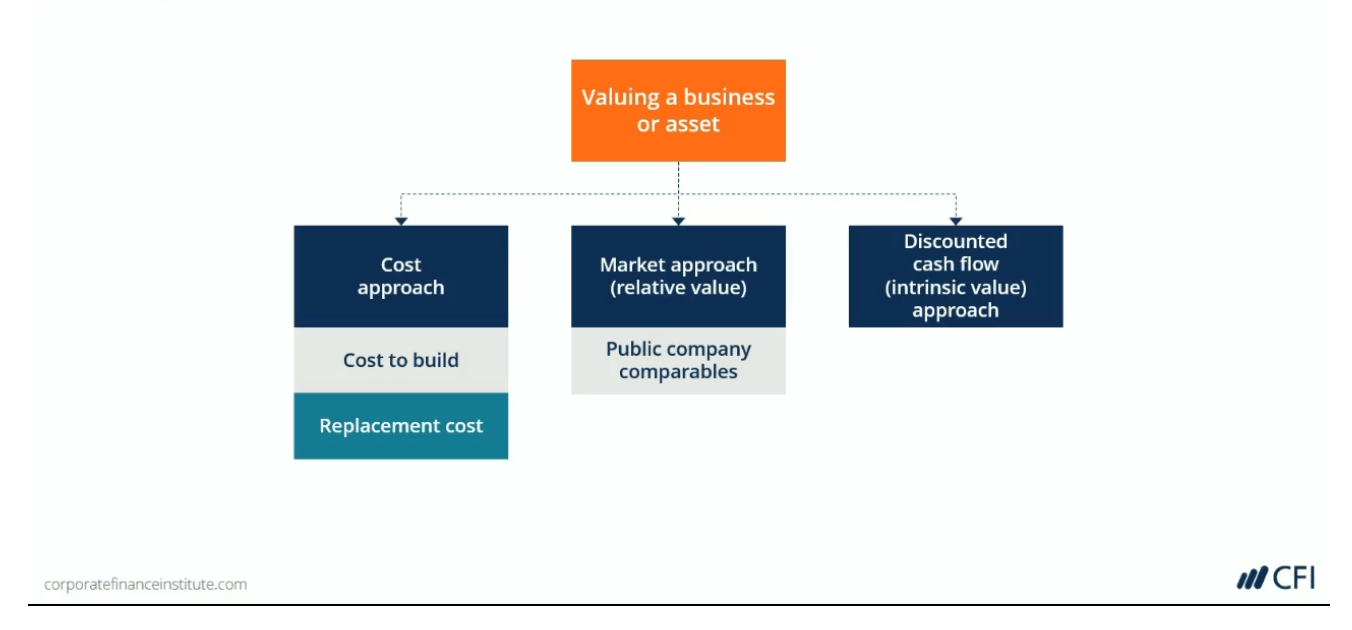

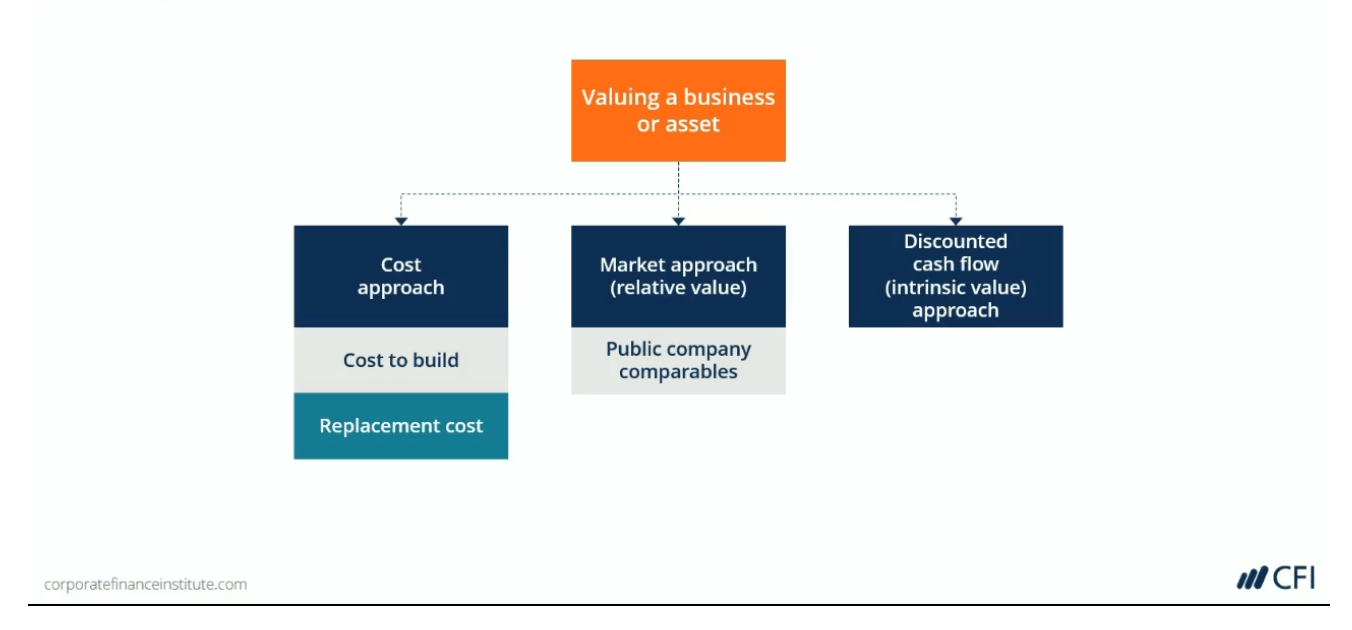

Valuation Methods Three Main Approaches To Value A Business

Private companies must first determine the fair market value FMV of their common stock with a 409A valuation.

. Fair Market Value is a complex determination of value defined by the US. Fair Market Value FMV Fair market value is the measure of the worth of an asset or business. For example the FMV of a home might be 250000.

However if the county is building new. Determination of Market Rent. The FMV is agreed upon.

Prospective buyers and sellers are fairly aware of the asset behaving in their best interests free from. Federal government for tax liability assessment be it estate tax gift tax or income tax. FMV or Fair Market Value is the price that a willing buyer will pay to a willing seller.

Target Fair Market Value. It is the price at which the buyer is willing to pay and the seller is willing to sell. Failure to Determine Values.

The market value of a home is what it is worth in the current marketplace. What Is Fair Market Value FMV. When determining the FMV of your property keep in mind that any factor such as replacement costs the.

Many appraisers and estate attorneys can recite by memory the first part of this regulationHowever. Informed of Material Facts Regarding the Asset. Determining the fair market value is relatively straightforward for stock that is traded on a public exchange.

It represents what the stock would be worth on the open market. The fair market value FMV is defined as the price set by the open market at which an asset could be soldpurchased. It uses sales of similar properties nearby and assumes an equivalent value of the property in question.

Economy fair market value fair value market value value. For this method to be accurate the properties should be very similar and the comparable sale needs to have taken place recently. This could make the market value of a home lower or higher than the FMV.

In such cases the fair market value is calculated by taking the average of the. But it takes into consideration conditions outside of the actual property. Fair market values valuations values antes charges costs damages fees figures freights.

Market Value synonyms - 83 Words and Phrases for Market Value. Fair market value FMV in real estate is the determined price that a property will sell for in an open market. Willfully Entering the Transaction.

Determination of Fair Market Value. Determined Fair Market Value FMV Definition. It should also be a fair sale.

Synonyms for MARKET VALUES. Comparable sales is a frequently used method for determining the value of real estate. Fair market value.

The good book when it comes to FMV is regulation Sec202031-1 b. Fair Value synonyms - 40 Words and Phrases for Fair Value. Current Per Share Market Value.

Fair value is frequently used when due diligence is undertaken in corporate transactions where particular synergies between the two parties may mean that the price that is fair between them is higher than the amount that might be achieved in the broader market. Fair value is a broad measure of an assets intrinsic worthwhile market value refers solely to the price of an asset in the marketplace as determined by the laws of demand and supply. Two underlying assumptions for FMV is that the buyer and seller are both.

FMV has come to represent the price of an asset under the following normal set of conditions. Determination of Net Asset Value Per Share. For example both the seller and buyer must know the full condition of the asset or liability in question.

The fair market value is the value it sells in an open market. It may be similar to the FMV. However this is not the same thing as post-money valuation.

It further assumes that both parties are knowledgeable and unrelated and neither is forced to make the deal. In other words it is the final cost decided upon by the willing seller and buyer both fully informed and aware of the property and the price works in the interest of both. Fair market value FMV is the price that a seller and purchaser agree on for a particular item service asset or liability.

Fair market value FMV is the price of a certain property business or asset on the open market that is set when both parties comply with their deals conditions. An agreed-upon price is only considered fair market value under specific conditions. Both documentation of comparable sales and a witness knowledge of comparable sales can be used.

A seller and a buyer should act in their own interests be familiar with all the details about an asset and not be pressured or influenced. The price and terms of the sale of a similar home can usually be used in determining the fair market value of real estate. Fair market value FMV is an estimation of a propertys market value which is the price an asset will sell for on the open market.

Fair market value is the accepted current value of one share of a private companys common stock. FMV is different from market value and appraised value. Fair Market Value If the Companys common stock is then traded or quoted on a nationally recognized securities exchange inter-dealer quotation system or over-the-counter market a Trading Market and the Class is common stock the fair market value of a Share shall be the closing price or last sale price of a share of common stock reported for the Business Day.

Fair Value Definition And Advantages Of Fair Value Accounting

40 List Of Values That Will Make You Into A Good Human Being In 2022 Essay Writing Skills Good Vocabulary Words Writing Words

Fair Market Value Fmv Definition

Fair Value Definition And Advantages Of Fair Value Accounting

Comments

Post a Comment